42 consider a zero coupon bond with 20 years to maturity

Yield to maturity - Wikipedia Consider a 30-year zero-coupon bond with a face value of $100. ... With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of the bond is just 7%, and the yield-to-maturity bargained for when the bond was purchased was only 10%, the annualized return earned over the first 10 years is … Solved Consider a zero-coupon bond with 20 years to - Chegg Finance. Finance questions and answers. Consider a zero-coupon bond with 20 years to maturity. The price at which this bond will trade if the YTM is 6% is closest to: Select one: O A. $306. OB. $312 O c. $335. O D. $215. Question: Consider a zero-coupon bond with 20 years to maturity. The price at which this bond will trade if the YTM is 6% is ...

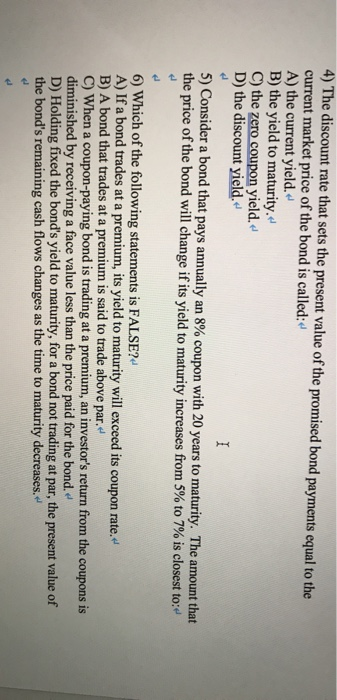

Solved Consider a zero-coupon bond with 20 years to | Chegg.com This problem has been solved! See the answer Consider a zero-coupon bond with 20 years to maturity. The amount that the price of the bond will change if its yield to maturity decreases from 7% to 5% is closest to: Expert Answer 100% (1 rating) Previous question Next question

Consider a zero coupon bond with 20 years to maturity

25 Consider a zero coupon bond with 20 years to maturity and a face ... 25 Consider a zero coupon bond with 20 years to maturity and a face value of 25 consider a zero coupon bond with 20 years to SchoolStony Brook University Course TitleECO 389 Type Notes Uploaded ByKidHackerMonkey8347 Pages9 Ratings99%(102)101 out of 102 people found this document helpful This previewshows page 8 - 9out of 9pages. Yield to maturity - Wikipedia Consider a 30-year zero-coupon bond with a face value of $100. If the bond is priced at an annual YTM of 10%, it will cost $5.73 today (the present value of this cash flow, 100/(1.1) 30 = 5.73). Over the coming 30 years, the price will advance to $100, and the annualized return will be 10%. QUESTION 21 Consider a zero coupon bond with 20 years to maturity The ... QUESTION 21 Consider a zero-coupon bond with 20 years to maturity. The price this bond will trade at ifthe YTM is 6% is closest to: $215 $312 $335 $306 Bond value 1000 1+0.06^20 Bond value 1000 3.207135472 Bond value $ 312 QUESTION 22 An investor purchases a 30-year, zero-coupon bond with a face value of $1000 and a yield to maturity of 6.5%.

Consider a zero coupon bond with 20 years to maturity. Consider a zero coupon bond with 1000 face value and 20 years to ... Compute PV = N)i1( FV = 10)0.1041( 1000 = 371.80 20) Consider a zero-coupon bond with a $1000 face value and ten years left until maturity. Financial Management Exam 3 Flashcards | Quizlet Consider a zero coupon bond with 20 years to maturity. The price will this bond trade if the YTM is 6% is. $311.80. Consider a zero-coupon bond with a $1000 face value and 10 years left until maturity. If the YTM of this bond is 10.4%, then the price of this bond is. 371.80. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. Solved Consider a zero coupon bond with 20 years to maturity | Chegg.com 1) The current yield is: 2). The yield to maturity is: Please show work. Question: Consider a zero coupon bond with 20 years to maturity and $25,000 face value if the current market price is $15,000. (Use semiannual compounding in your calculations). 1) The current yield is: 2). The yield to maturity is: Please show work.

Zero-Coupon Bond Definition - Investopedia Upon maturity, the investor gains $25,000 - $20,991 = $4,009, which translates to 6% interest per year. The greater the length of time until the bond matures, the less the investor pays for it, and... How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... Solved Consider a zero coupon bond with 20 years to - Chegg Consider a zero coupon bond with 20 years to maturity. The amount that the price of the bond will change if its yield to maturity decreases from 7% to 5% is closest to: O A. $673 OB. - $53 O C. $120 OD. $53 Questio ; Question: Consider a zero coupon bond with 20 years to maturity. The amount that the price of the bond will change if its yield ... Zero Coupon Bond | Definition, Formula & Examples - Study.com Consider a newly issued 20-year, zero-coupon bond with a $1,000 face value and 8% required return. Determine the imputed interest income for the bond in its first, second, and last year of life, assu

Bond Yield to Maturity Calculator for Comparing Bonds Let's say you buy a 10 year $1000 bond with a 5% coupon. You hold that bond for the next few years collecting your $50 of annual interest. During that time, interest rates fall, and a comparable 10 year $1000 bond now carries a 4% coupon. Your original bond is now a much more valuable commodity, and it can be sold at a premium on the open market. What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · Another type of bond is a zero coupon bond, which does not pay interest during the time the bond is outstanding. Rather, zero coupon bonds are sold at a discount to their value at maturity. Maturity dates on zero coupon bonds tend to be long term, often not maturing for 10, 15, or more years. BUS307 Ch6 Participation and HW Flashcards | Quizlet 25 -year zero-coupon bonds. If the yield to maturity on the bonds will be 7% (annual compounded ... Consider a zero-coupon bond with a $5,000 face value and 20 years left until maturity. If the bond is currently trading for $2,130 , then the yield to maturity on this bond is closest to: Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest. Compound Interest Compound interest is ...

Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Example of a Zero-Coupon Bonds Example 1: Annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? 5 = $783.53. The price that John will pay for the bond today is $783.53. Example 2 ...

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

Strip Bonds Definition - Investopedia 17.08.2020 · Strip Bond: A strip bond is a bond where both the principal and regular coupon payments--which have been removed--are sold separately. Also …

Problem Set #11 Solutions 1. Consider two bonds, A and B ... Consider two bonds, A and B. Both bonds presently are selling at their par value of $1,000. Each pays interest of $120 annually. Bond A will mature in 5 years, while bond B will mature in 6 years. If the yields to maturity on the two bonds change from 12% to 14%, _____. A. both bonds will increase in value but bond A will increase more than bond B

6.2.2 Flashcards | Quizlet C) The yield to maturity for a zero-coupon bond is the return you will earn as an investor from holding the bond to maturity and receiving the promised face value payment. D) When prices are quoted in the bond market, they are conventionally quoted in increments of $1,000. D Consider a zero-coupon bond with $100 face value and 15 years to maturity.

Post a Comment for "42 consider a zero coupon bond with 20 years to maturity"