40 yield to maturity of zero coupon bond

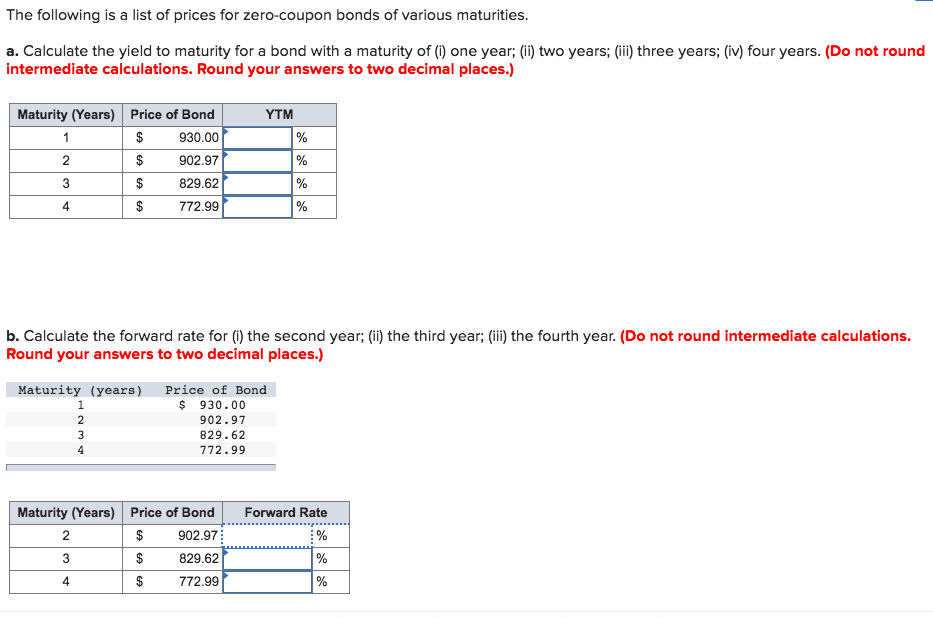

Solved The yield to maturity on one-year zero-coupon bonds | Chegg.com The yield to maturity on one-year zero-coupon bonds is 8.4%. The yield to maturity on two-year zero-coupon bonds is 9.4%. a. What is the forward rate of interest for the second year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Forward rate of interest % b. If you believe in the expectations hypothesis ... Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com = $5,317 This gain of $5,317 is made up of the unwinding of discount (the increase in present value as it nears maturity) plus capital gain portion that results from positive movement in market yield on the bond. The value of zero-coupon bond will continue to increase till it reach $100,000 at the time of its maturity.

Yield to maturity of zero coupon bond

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ... The stated yield to maturity and realized compound yield to | Quizlet In which one of the following cases is the bond selling at a discount? (1) Coupon rate is greater than current yield, which is greater than yield to maturity. (2) Coupon rate, current yield, and yield to maturity are all the same. (3) Coupon rate is less than current yield, which is less than yield to maturity.

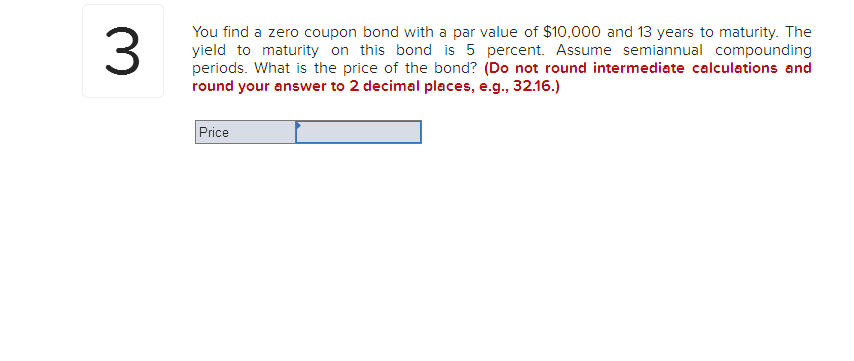

Yield to maturity of zero coupon bond. [Solved]: A \( 13.35 \)-year maturity zero-coupon bond sel a) zero coupon bond yield to maturity = 8% number of years = 13.35 face value = $1,000 and PMT = 0 by using excel function PV = PV(8%,13.35,0,-1000) = We have an Answer from Expert Buy This Answer $5 21. The yield-to-maturity of an 8-year zero coupon bond, The yield-to-maturity of an 8-year zero coupon bond, with a par value of $1,000 and a market price of $700, is - Answered by a verified Business Tutor ... Suppose you purchase a 30 -year, zero-coupon bond with a yield to maturity of 6.1 %. You hold the bond for five years before selling it. a. Given the following zero-coupon yields, compare the yield to maturity ... From the information provided, the yield to maturity of the three-year zero-coupon bond is 4.50%. Also, because the yields match those in Table 6.7, we already calculated the yield to maturity for the 10% coupon bond as 4.44%. To compute the yield for the 4% coupon bond, we first need to calculate its price, which we can do using Eq. 6.4. Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

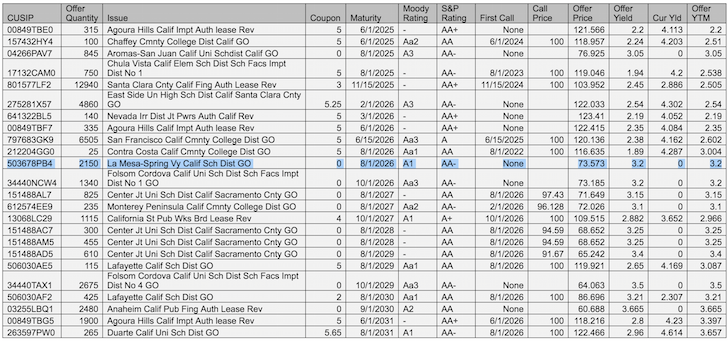

YIELDS TO MATURITY ON ZERO-COUPON RONDS - ebrary.net However, there is no inherent reason why the annual yield on a zero-coupon bond cannot be calculated for quarterly, monthly, daily, or even hourly compounding. Those yields turn out to be 5.141%, 5.119%, 5.109%, and 5.108% using PER = 4,12, 365, and 365 * 24, respectively. Alternatively, you could convert from any one periodicity to any other ... Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top What is the yield to maturity (YTM) of a zero coupon bond with a face ... Answer (1 of 2): YTM is 5.023%. Bond mathematics tend to be easier to calculate on a spreadsheet as seen below: Calculated the Yield first using RATE function. Parameters can be found out using the 'fx' button in MS Excel. You can see the parameters used in the above image as well viz. B6*B7 ->... Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax...

Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = ... Suppose that over the first 10 years of the holding period, interest rates decline, and the yield-to-maturity on the bond falls to 7%. With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of ... How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be. How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield to maturity is an essential investing concept used to compare bonds of different coupons and times until maturity. Without accounting for any interest payments, zero-coupon bonds always... Solved The Yield To Maturity On One Year Zero Coupon Bond Chegg Round your answer to 2 question the yield to maturity on 1 year zero coupon bonds is currently 5 the ytm on 2 year zeros is 6- the treasury plans to issue a 2 y

What Is a Zero-Coupon Bond? Definition, Advantages, Risks As of November 2020, the current yield-to-maturity rate on the PIMCO 25+ year zero-coupon bond ETF, a managed fund consisting of a variety of long-term zeros, is 1.54%. The current yield on a 20 ...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter In the given formula, the numeral of zero (0) represents that there is no coupon yet. Face Value (F) Rate/Yield (r) Time to Maturity (t) = When the term zero-coupon bond comes, the two words urgently come into mind; one is the pure discount bond, and the other one is the discount bond. Both of these words represent the common zero coupon bond term.

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05/2) 5*2 = $781.20 The price that John will pay for the bond today is $781.20.

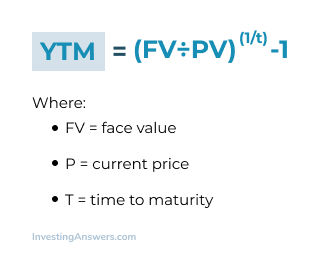

Zero-Coupon Bond: Formula and Calculator [Excel Template] To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Solved 15, A zero-coupon bond has a yield to maturity of 9% | Chegg.com Transcribed image text: 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C. $513.16 D. $483 49 today 16.

How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ...

The stated yield to maturity and realized compound yield to | Quizlet In which one of the following cases is the bond selling at a discount? (1) Coupon rate is greater than current yield, which is greater than yield to maturity. (2) Coupon rate, current yield, and yield to maturity are all the same. (3) Coupon rate is less than current yield, which is less than yield to maturity.

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

Post a Comment for "40 yield to maturity of zero coupon bond"