39 what is the coupon rate of a bond

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. Consider a coupon bond that has a \ 900 par value and a coupon rate of ... Consider a coupon bond that has a \ 900 par value and a coupon rate of 6 \%. The bond is currently selling for \ 860.15 and has two years to maturity. What i...

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a...

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

What is the coupon rate of a bond

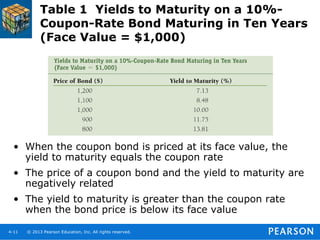

What is the relationship between coupon rate and bond price? The Bond price is the amount of the bond when it becomes mature. The coupon rate is the amount of interest payable on the bond.Bonds have three major componentsThe first is the face value (also ... Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

What is the coupon rate of a bond. Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, What Is the Coupon Rate of a Bond? | SoFi A coupon rate is the nominal interest rate or yield associated with a fixed-income security. A bond coupon rate represents the annual interest rate paid on a bond by the issuer, as determined by the bond's face value. Issuers typically pay bond coupon rates on a semiannual basis. The coupon rate of a bond can tell an investor how much ... WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. A point ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Coupon Bond - Investopedia The yield the coupon bond pays on the date of its issuance is called the coupon rate. The value of the coupon rate may change. Bonds with higher coupon rates are more attractive for... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates, etc, Please provide us with an attribution link. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Note

The $1,000 will be returned at - tju.dapptools.info There is also a coupon that represents the interest rate. For instance, if the company has issued 20% coupon bonds valued at $100, the interest value is $20. Bonds often issued at the par value. The coupon rate a fixed charged on. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. How to Calculate the Price of Coupon Bond? - WallStreetMojo The company plans to issue 5,000 such bonds, and each bond has a par value of $1,000 with a coupon rate of 7%, and it is to mature in 15 years. The effective yield to maturity is 9%. Determine the price of each bond and the money to be raised by XYZ Ltd through this bond issue. Below is given data for the calculation of the coupon bond of XYZ Ltd. Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership. Bond The equations that the algorithm is based on are: Current bond yield = Annual interest payment / Bond's current clean price; Annual interest payment = Bond's face value * Bond's coupon rate (interest rate) * 0.01. As the bond has no interest payments, the only cash flow is the face value of the bond received at the maturity date. Zero ...

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

What Is a Fixed-Rate Bond? - Investopedia A fixed-rate bond is a debt instrument with a level interest rate over its entire term, with regular interest payments known as coupons. Upon maturity of the bond, holders will receive back...

Calculate bond value with discount rate 1. When the coupon rate is above the discount rate , the bond value is _____ the face value and is considered to be at a _____. 2. Smith Darby has issued a five-year bond with a coupon rate of 8%.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value...

Coupon Definition - Investopedia What Is a Coupon? A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are...

What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

What is the relationship between coupon rate and bond price? The Bond price is the amount of the bond when it becomes mature. The coupon rate is the amount of interest payable on the bond.Bonds have three major componentsThe first is the face value (also ...

Post a Comment for "39 what is the coupon rate of a bond"