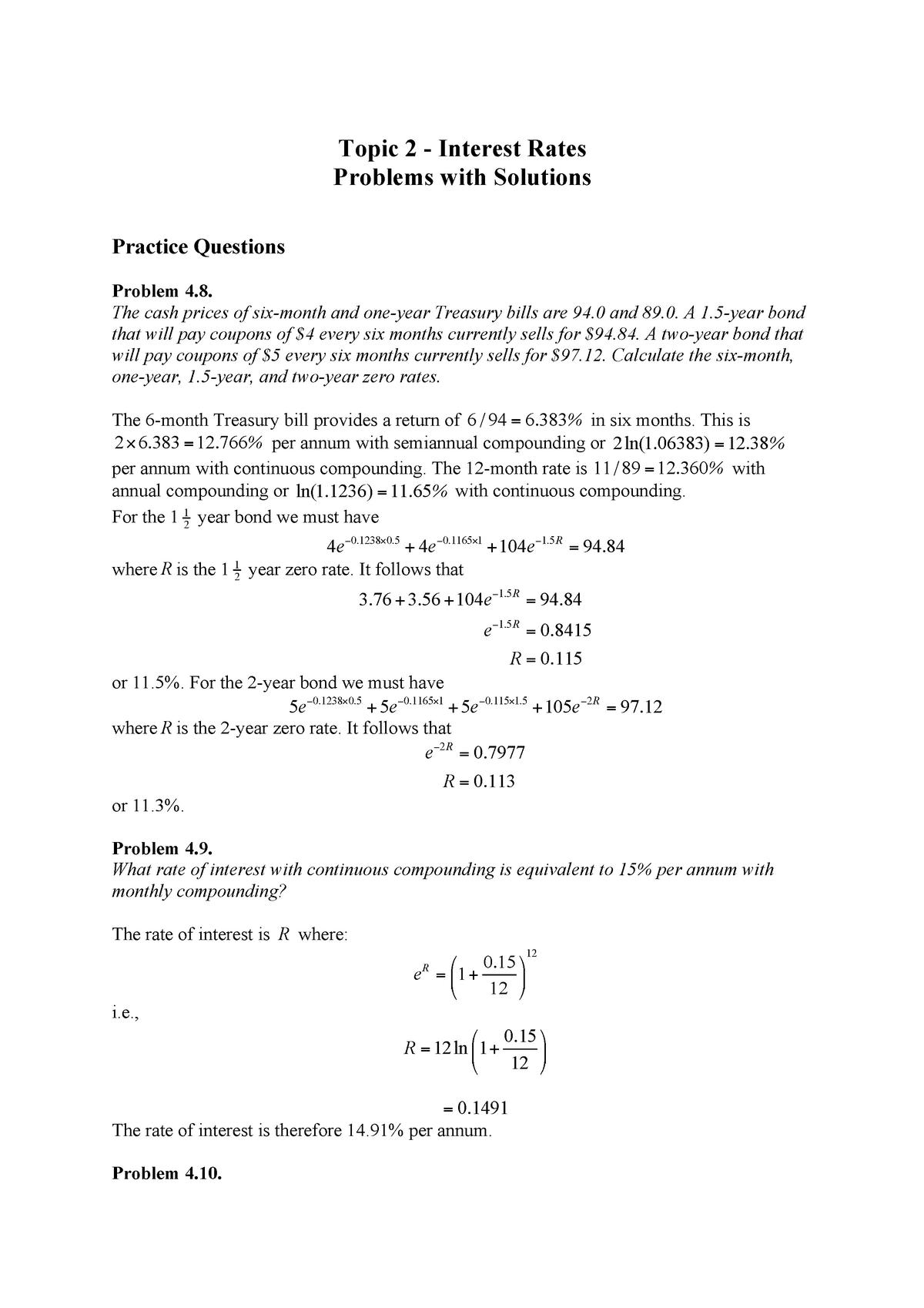

42 treasury bills coupon rate

What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia T-bills are zero-coupon bonds that are usually sold at a discount and the difference between the purchase price and the par amount is your accrued interest. Treasury Bills - Guide to Understanding How T-Bills Work Jan 23, 2022 · How to Purchase Treasury Bills. Treasury bills can be purchased in the following three ways: 1. Non-competitive bid. In a non-competitive bid, the investor agrees to accept the discount rate determined at auction. The yield that an investor receives is equal to the average auction price for T-bills sold at auction.

Treasury Bills Explained" - Grmbulls Well, Treasury bill ek aisa money market instrument hai jo Government of India issue karta hai as a promissory note with a guaranteed repayment at a later rate. Yeh bill 0 Coupon securities hai aur investors ko yahan koi interest nahi dia jaata hai lekin phir bhi investors acha khasa paisa kamate hain.

/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg)

Treasury bills coupon rate

What Is a Treasury Note? How Treasury Notes Work for Beginners Treasury bills have maturities of two, three, five, seven, and ten years. Treasury bills, notes, and bonds, are all forms of debt commitments that the United States Treasury sells. ... Treasuries pay interest in the form of coupons. The coupon rate is set before the bond gets issued and is charged every six months. What Are Treasury Yields ... Should You Buy Treasuries? - Forbes The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. (Note: both figures are annualized, so... TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Historical Quotes Key Data Open 3.984% Day Range 3.790 - 4.199 52 Week Range -0.376 - 4.215 Price 3 31/32 Change 6/32 Change Percent 4.81% Coupon Rate 0.000% Maturity Oct 5, 2023 Performance Change...

Treasury bills coupon rate. Individual - Treasury Notes: Rates & Terms Treasury Bills. Treasury Notes. Buy. Reinvest or Redeem. Sell. Transfer. Rates & Terms. Tax Consider-ations. Product FAQs. ... Treasury Notes: Rates & Terms . Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. ... Interest Coupon Rate Price Explanation; Discount (price below par) 10-year Note Issue Date ... Treasury Bills | Constant Maturity Index Rate Yield Bonds Notes US 10 5 ... Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers. Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S. Treasury Index...

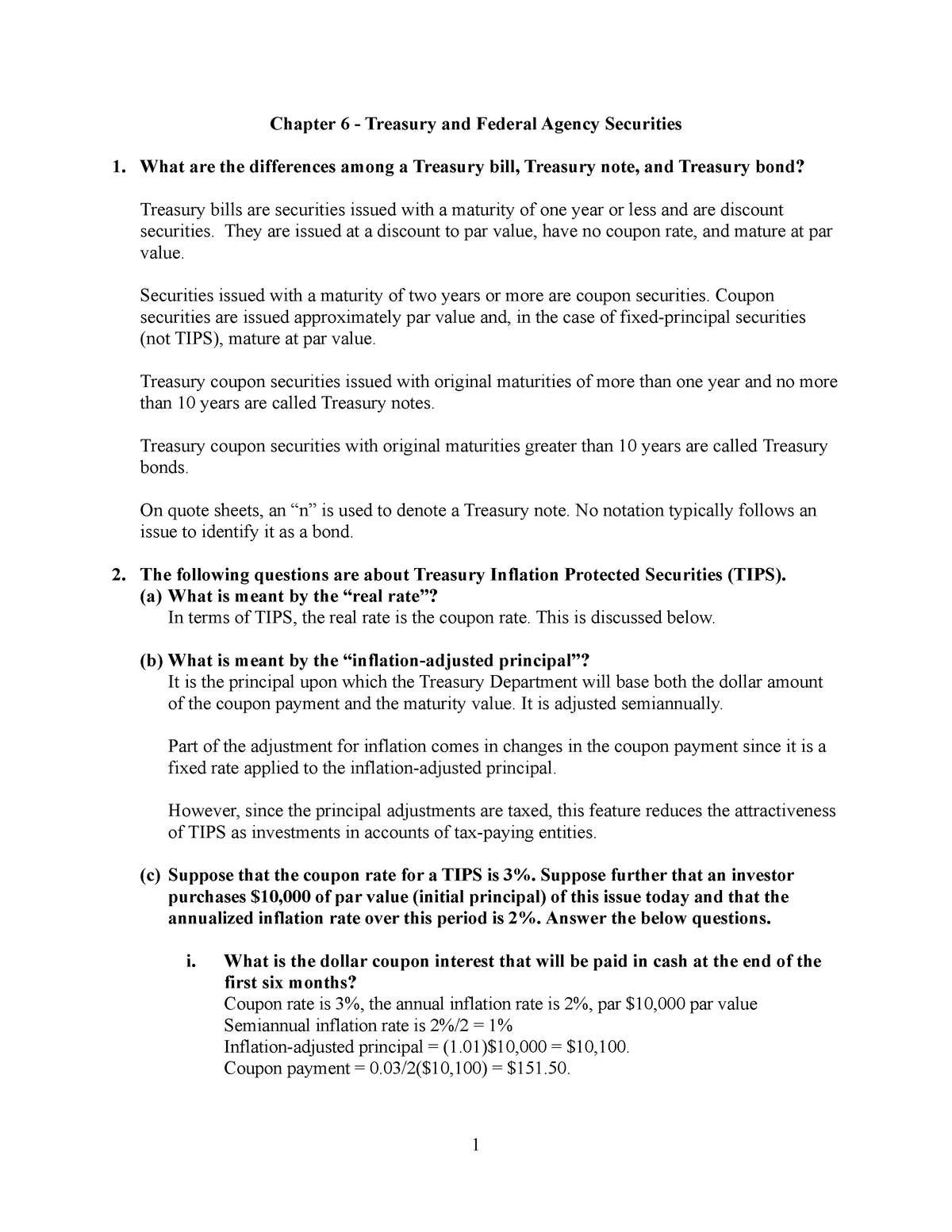

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value ... Treasury Bond (T-Bond) Definition - Investopedia Apr 02, 2022 · Treasury Bond - T-Bond: A Treasury bond (T-Bond) is a marketable, fixed-interest U.S. government debt security with a maturity of more than 10 years. Treasury bonds make interest payments semi ... Individual - Treasury Bills: Rates & Terms You would pay $98 for the bill at purchase and you would get $100 when the bill matures. The difference of $2 is your interest. Unlike Treasury notes, Treasury bonds, and Treasury Inflation-Protected Securities (TIPS), bills don't pay interest every six months.

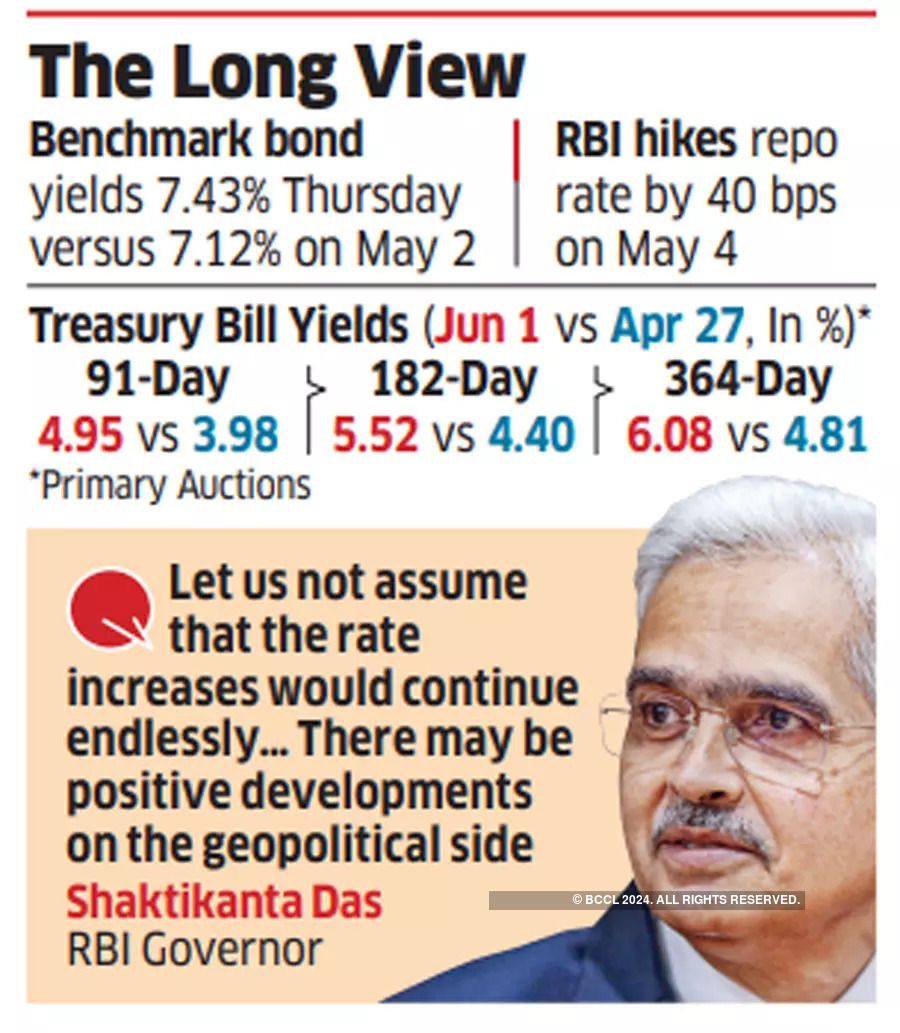

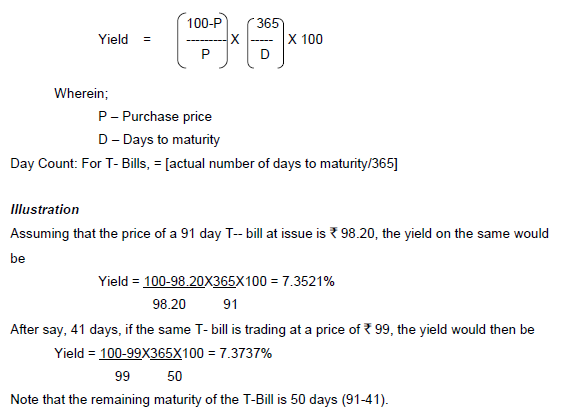

Individual - Treasury Bills In Depth Treasury Bills In Depth Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).* When the bill matures, you would be paid its face value, $1,000. Treasury Bills vs Bonds | Top 5 Best Differences (With ... Treasury Bills. Treasury bills categories into 3 bills as per maturity namely, a) 91 Day b) 182 Day c) 364 Day. Treasury bills are sold out at a discounting price, and it did not pay any interest. Treasury Bills is also called as T-Bills. A treasury bill is only typed instrument which is found in both capital and money market. Resource Center | U.S. Department of the Treasury Select type of Interest Rate Data. Daily Treasury Par Yield Curve Rates, Daily Treasury Bill Rates, Daily Treasury Long-Term Rates, Daily Treasury Par Real ... How Is the Interest Rate on a Treasury Bond Determined? Aug 29, 2022 · This is known as the coupon rate. For example, a $10,000 T-bond with a 5% coupon will pay out $500 annually, regardless of what price the bond is trading for in the market. Factors Affecting ...

How Are Treasury Bill Interest Rates Determined? - Investopedia For example, suppose an investor purchases a 52-week T-bill with a face value of $1,000. The investor paid $975 upfront. The discount spread is $25. After the investor receives the $1,000 at the...

Nigeria Treasury Bills and Bonds Auction Results Aug 10, 2022 · How to invest in Nigerian Treasury Bills, NTB Rates, Federal government bonds, NTB, primary auction. ... Marginal Rate: 91 days: 182 days: 364 days: Sep 28, 2022 ...

Treasury Bills (T-Bills) - What They Are & How to Buy for ... Sep 14, 2021 · However, unlike other offerings by the Treasury, they offer very short terms, greatly reducing the interest-rate risk associated with investing in fixed-income securities. T-bills mature in less than one year, whereas investments in Treasury notes mature in one to 10 years and investments in Treasury bonds typically take 30 years to mature.

Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors

How To Invest in Treasury Bills - Investment Firms Treasury bills are sold at a discount rate, discounted from the face value of the security. For example, if the face value of a T-bill is $100,000 and is being sold at a discount rate of 1.5%; you would purchase the security for $98,500 and be paid $100,000 at the end of the bill's maturity. This implies you buy T-bills for a lower price than ...

US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Oct 05, 2022 · Coupon 2.75%; Maturity 2032-08-15; Latest On U.S. 10 Year Treasury. ALL CNBC INVESTING CLUB PRO. Treasury yields rise as uncertainty over Fed interest rate policy spreads October 5, 2022 CNBC.com.

TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Historical Quotes Key Data Open 3.984% Day Range 3.790 - 4.199 52 Week Range -0.376 - 4.215 Price 3 31/32 Change 6/32 Change Percent 4.81% Coupon Rate 0.000% Maturity Oct 5, 2023 Performance Change...

Should You Buy Treasuries? - Forbes The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. (Note: both figures are annualized, so...

What Is a Treasury Note? How Treasury Notes Work for Beginners Treasury bills have maturities of two, three, five, seven, and ten years. Treasury bills, notes, and bonds, are all forms of debt commitments that the United States Treasury sells. ... Treasuries pay interest in the form of coupons. The coupon rate is set before the bond gets issued and is charged every six months. What Are Treasury Yields ...

:max_bytes(150000):strip_icc()/dotdash_Final_The_Predictive_Powers_of_the_Bond_Yield_Curve_Dec_2020-01-5a077058fc3d4291bed41cfdd054cadd.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

![1. [20 points] You observe the following Treasury | Chegg.com](https://media.cheggcdn.com/media/e27/e270d5a8-78a8-4494-b4e5-34ea83f2212f/php46N91z.png)

![1. [20 points] You observe the following Treasury | Chegg.com](https://media.cheggcdn.com/media/982/982ed877-b22d-4a05-b201-776ff4989f4a/phpimKzm7.png)

Post a Comment for "42 treasury bills coupon rate"