41 advantage of zero coupon bond

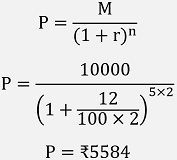

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Since the Interest accrued is discounted from the Par value of such Bonds at purchase, which effectively enables Investors of Zero Coupon Bonds to buy a greater number of such bonds compared to any other Coupon Bearing Bond. Zero-Coupon Bond Formula We can calculate the Present value by using the below-mentioned formula: What Is The Advantage Of Investing In A Zero Coupon Bond - Atish Lolienkar Advantage of zero coupon bond Guaranteed return Zero coupon bonds are issued for a rate much lower than the actual face value of the bond. Thus, it is evident that the investor will get the face value once maturity. The final price and the time when the investor will receive is defined, making it a guaranteed source of return on maturity.

Advantages Of Zero Coupon Bond - bizimkonak.com Zero Coupon Bonds - Taxation, Advantages. CODES (1 days ago) A zero-coupon bond is a preferred investment option since it is secured, especially if invested for the long term. Some of the benefits that these offers are: Predictable … Visit URL. Category: coupon codes Show All Coupons

Advantage of zero coupon bond

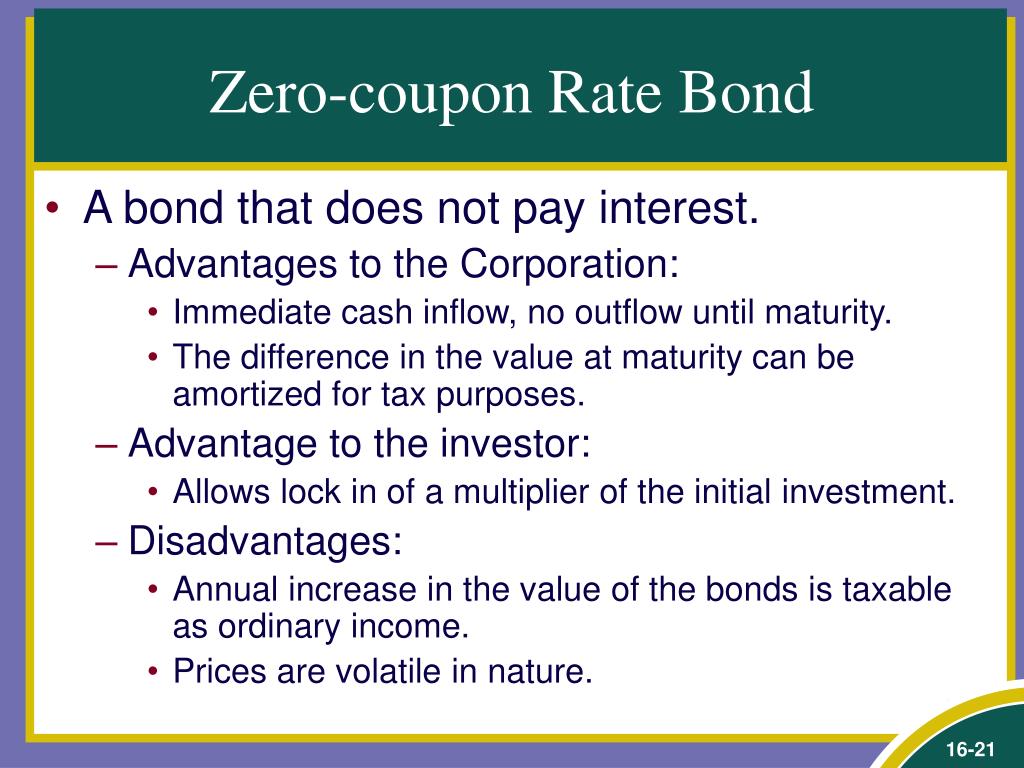

What is the disadvantage of issue zero coupon bond? - Quora What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival. Solved Which of the following statements is CORRECT? One - Chegg One advantage of a zero coupon Treasury bond is that no one who owns the bond has to pay any taxes on it until it matures or is sold. Long-term bonds have less price risk but more reinvestment risk than short-term bonds. If interest rates increase, all bond prices will increase, but the increase will be greater This problem has been solved! A zero-coupon bond is a discounted investment that can help you save ... Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a...

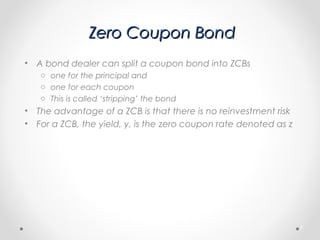

Advantage of zero coupon bond. What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a... What is a Zero-Coupon Bond? Definition, Features, Advantages ... Attainment of Long Term Financial Goals: A zero-coupon bond is a suitable option for the investors aiming at the fulfilment of long term (more than ten years) objectives such as child's education, marriage, post-retirement goals, etc. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right... Zero-Coupon Bonds | AnnuityAdvantage Zero-coupon bonds ("zeros") represent a type of bond that does not pay interest during the life of the bond. Instead, investors buy these bonds at a steep discount from the "face value" (the amount a bond will be worth when it matures).

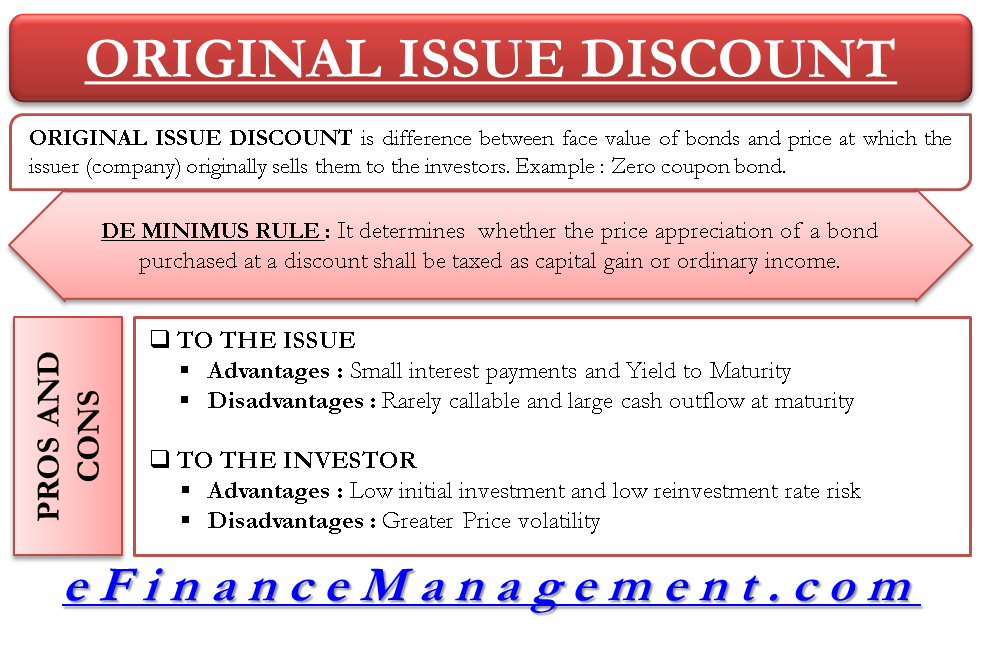

The Pros and Cons of Zero-Coupon Bonds - m.finweb.com Here are some of the pros and cons of investing in zero-coupon bonds. Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates. Chapter 7 Flashcards | Quizlet What are the advantages and disadvantages to a firm that issue low- or zero- coupon bonds?-From the perspective of the issuing firm, low or zero coupon bonds have the advantage of requiring low or no cash outflow during the life of the bond. The issuing firm is allowed to deduct the amortized discount as interest expense for federal income tax ... Invest in Zero Coupon Bond at Yubi | Learn All About It The imputed interest added to the purchase price gives yield to maturity of the zero coupon bond, which the investor receives automatically in the future as a phantom income. The long time horizon of zero coupon bonds is a major advantage for investors. With long-term maturity dates, bond buyers do not need to worry about the short term. What are the advantages and disadvantages of zero-coupon bond? What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival.

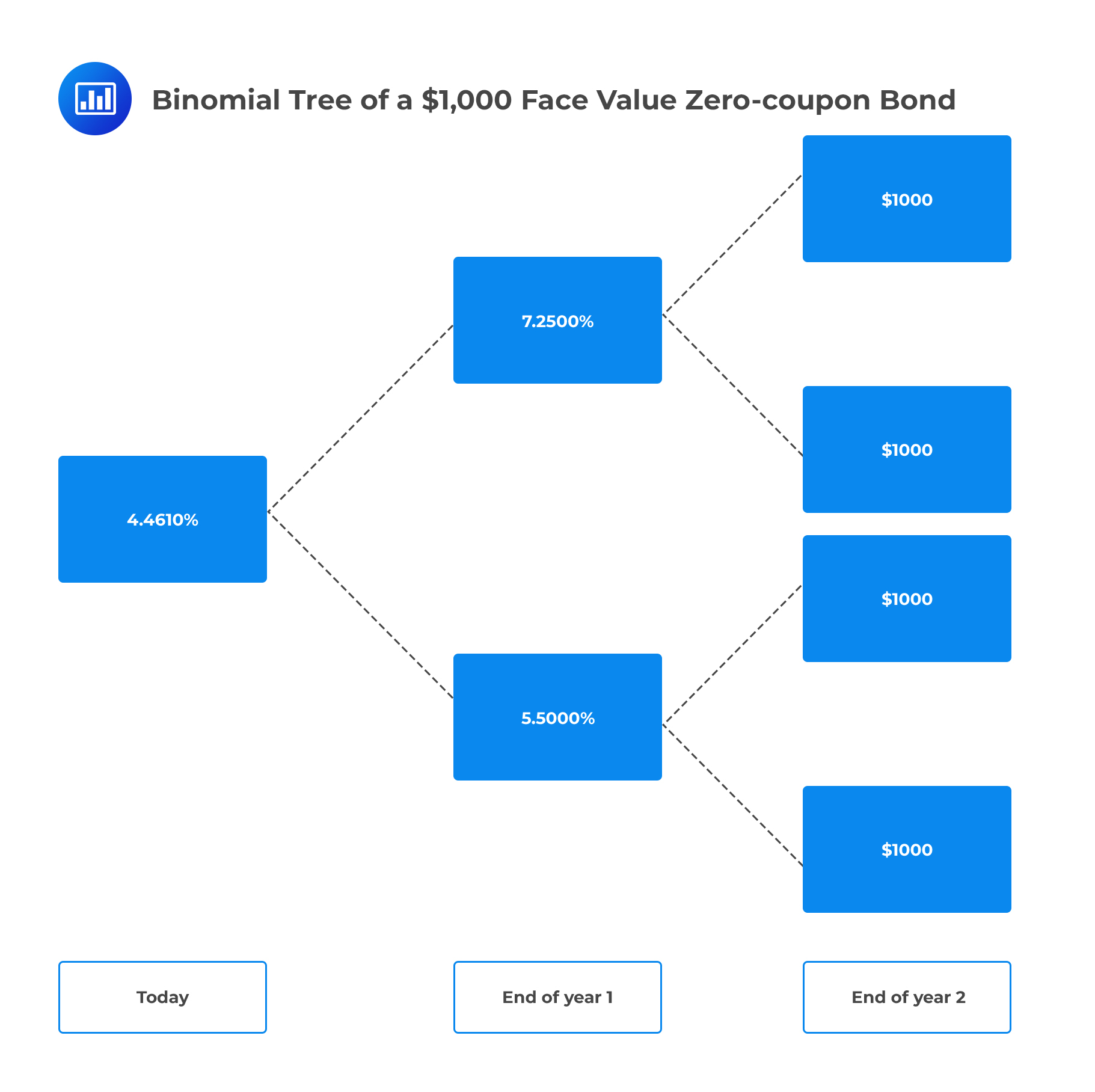

Solved Which of the following statements is CORRECT? One - Chegg One advantage of a zero coupon Treasury bond is that no one who owns the bond has to pay any taxes on it until it matures or is sold. Long-term bonds have less interest rate price risk but more reinvestment rate risk than short-term bonds. If interest rates increase, all bond prices will increase, but This problem has been solved! See the answer Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom This is because zero coupon bonds can help in securing a guaranteed return at the end of a fixed time period. Since these bonds offer discounts for longer investment tenures, they are ideal for those who have long-term investment plans. What are the benefits of investing in Zero-Coupon Bond? What Is a Zero-Coupon Bond? - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference... Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Unlike other bonds types, Zero-Coupon Bonds provides many advantages to the investors. Zero-Coupon Bonds is a good source to accumulate a fund to meet varied domestic or professional needs. It has no reinvestment risk and offers fixed returns. Zero-Coupon Bonds are a relatively safe tool for risk-free interest income.

What are Zero Coupon Bonds? | Features, Advantages, Disadvatages Advantages of Zero Coupon Bonds Long-Term in Nature Conservation of Cash No Reinvestment Risk Disadvantages of Zero Coupon Bonds Taxability Loss of Interest Highly Fluctuation Market Prices High Repayment Risk Return of Investors

Finance ch. 14-16 LearnSmart Flashcards | Quizlet The return to a purchaser of a zero-coupon bond is the difference between the investor's _____ and the _____ value of the bond. cost, face. ... T/F An advantage to the issuer of zero-coupon bonds is that the rate is typically lower than non zero-coupon bonds. False.

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments and have a lower element of risk involved. Long Dated zero coupon bonds are the most responsive to interest rate fluctuations. Therefore, it might be profitable for the bondholder in the case of a long duration (a higher 'N').

Advantages and Disadvantages of Bonds | Boundless Finance - Course Hero Advantages of Bonds Bonds have a clear advantage over other securities. The volatility of bonds (especially short and medium dated bonds) is lower than that of equities (stocks). Thus bonds are generally viewed as safer investments than stocks.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Advantages of Zero-Coupon Bonds. It is important to understand the advantages of a Zero Coupon bond before opting for this investment. The advantages are mentioned below: No reinvestment risk: Other coupon bonds don't allow investors to a bond's cash flow at the same rate as the investment's required rate of returns. But the Zero Coupon ...

A zero-coupon bond is a discounted investment that can help you save ... Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a...

Solved Which of the following statements is CORRECT? One - Chegg One advantage of a zero coupon Treasury bond is that no one who owns the bond has to pay any taxes on it until it matures or is sold. Long-term bonds have less price risk but more reinvestment risk than short-term bonds. If interest rates increase, all bond prices will increase, but the increase will be greater This problem has been solved!

What is the disadvantage of issue zero coupon bond? - Quora What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival.

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

Post a Comment for "41 advantage of zero coupon bond"