42 current yield coupon rate

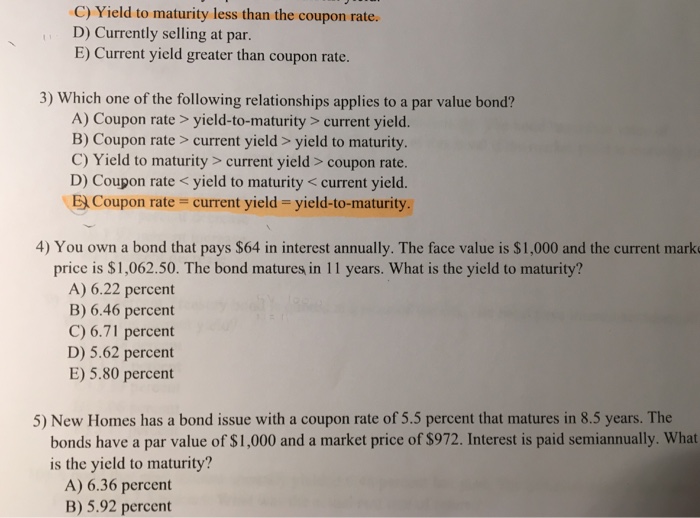

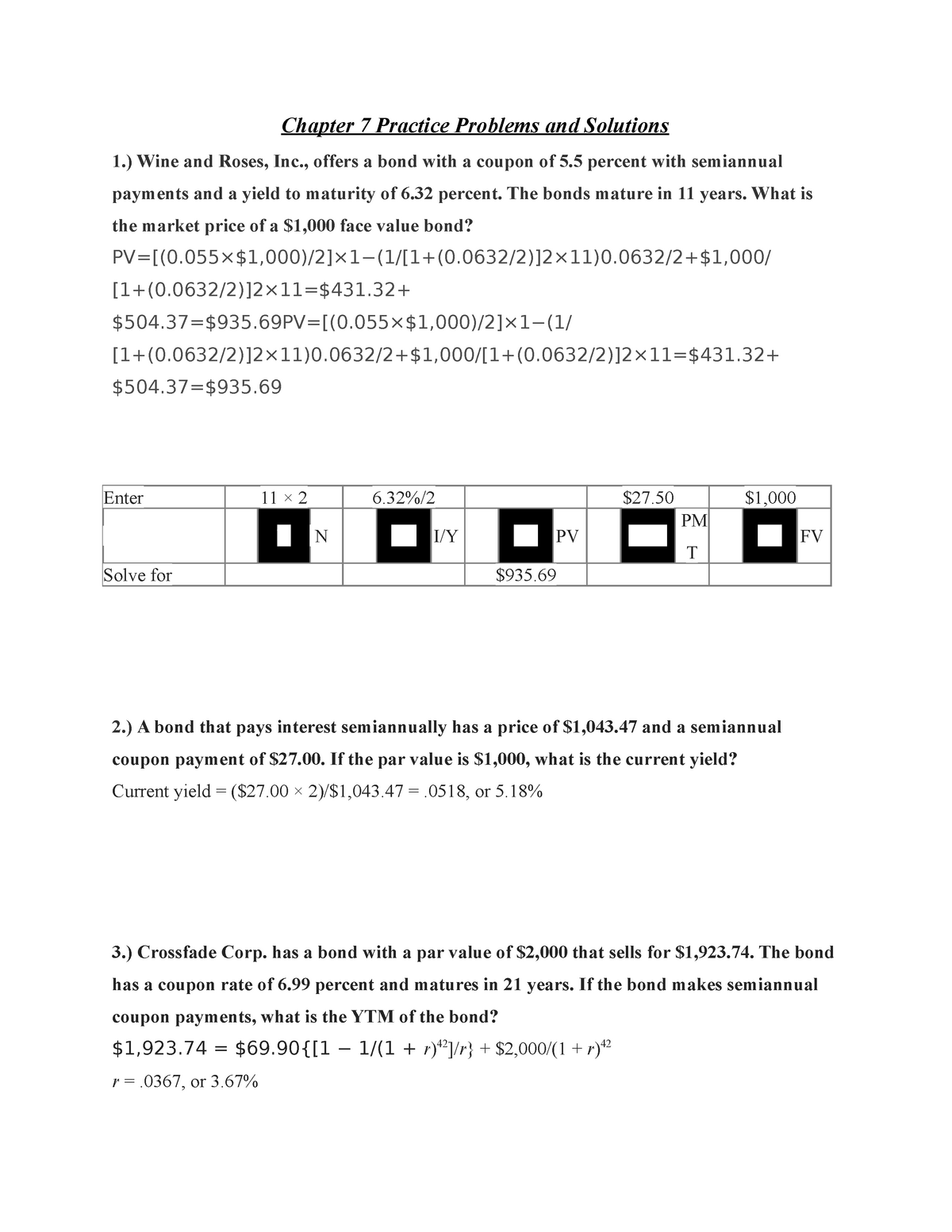

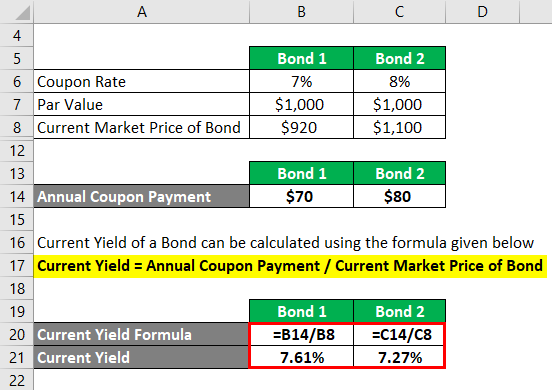

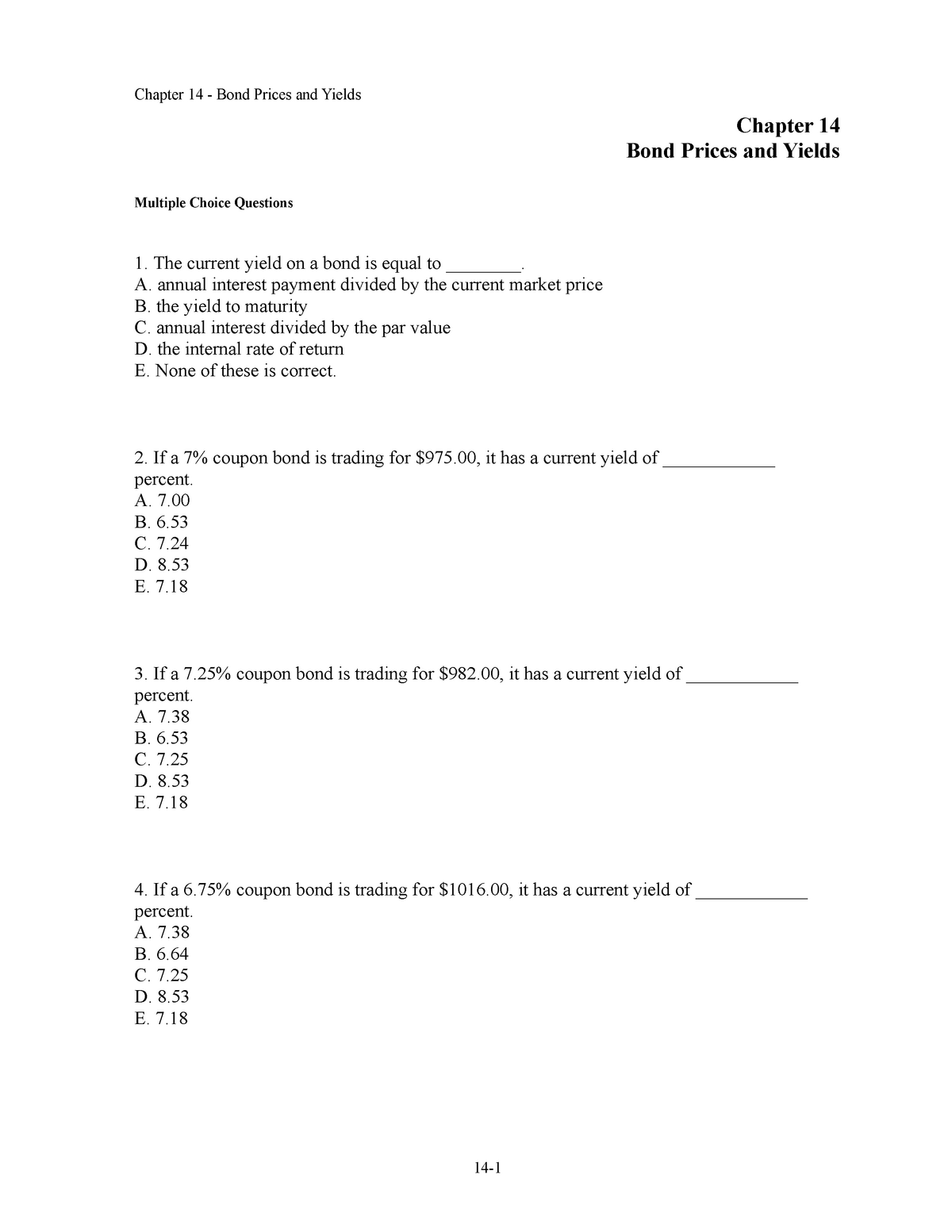

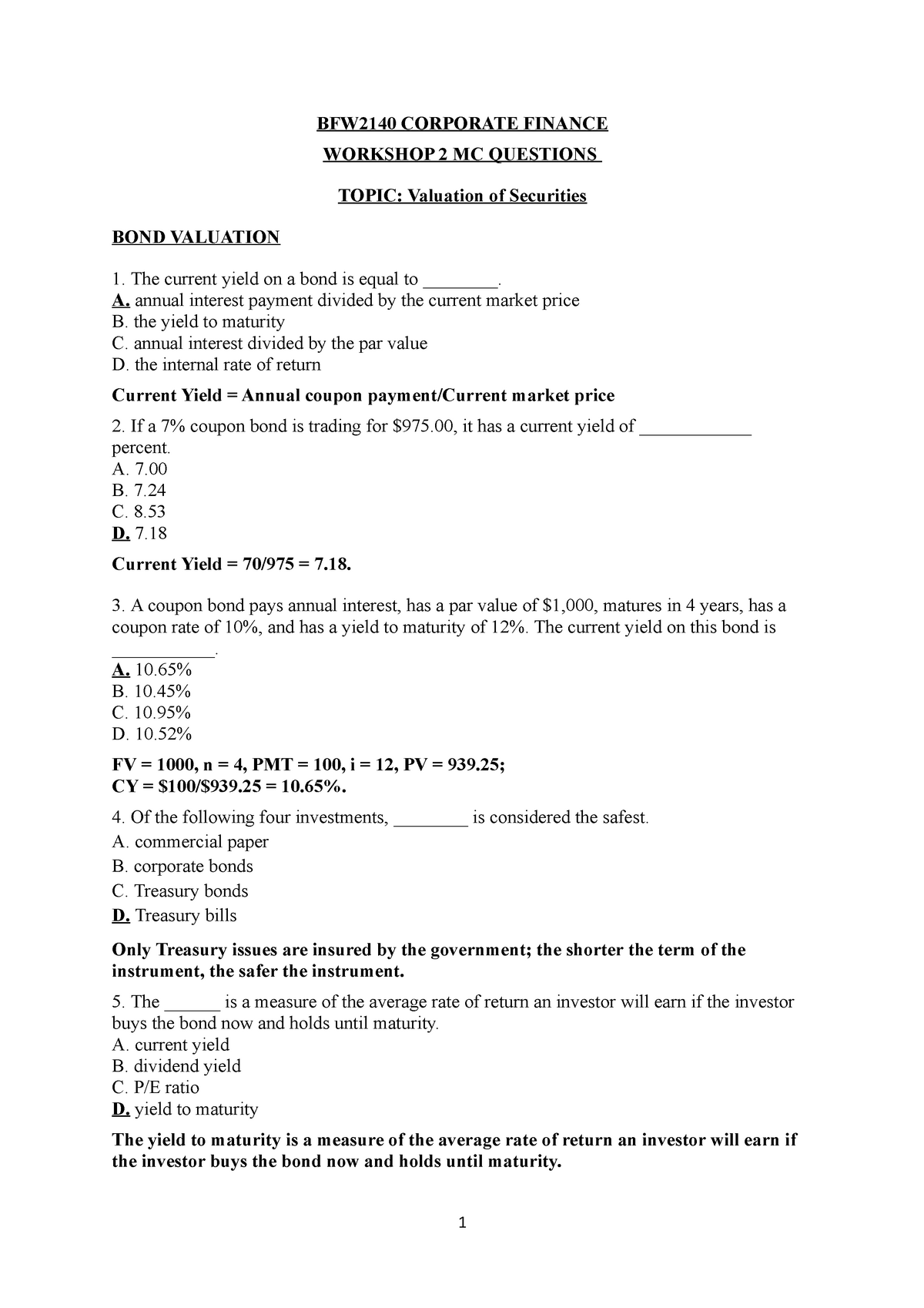

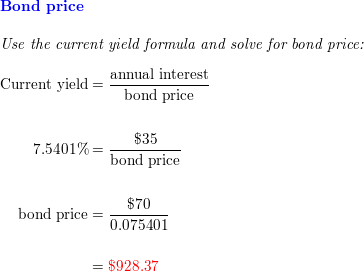

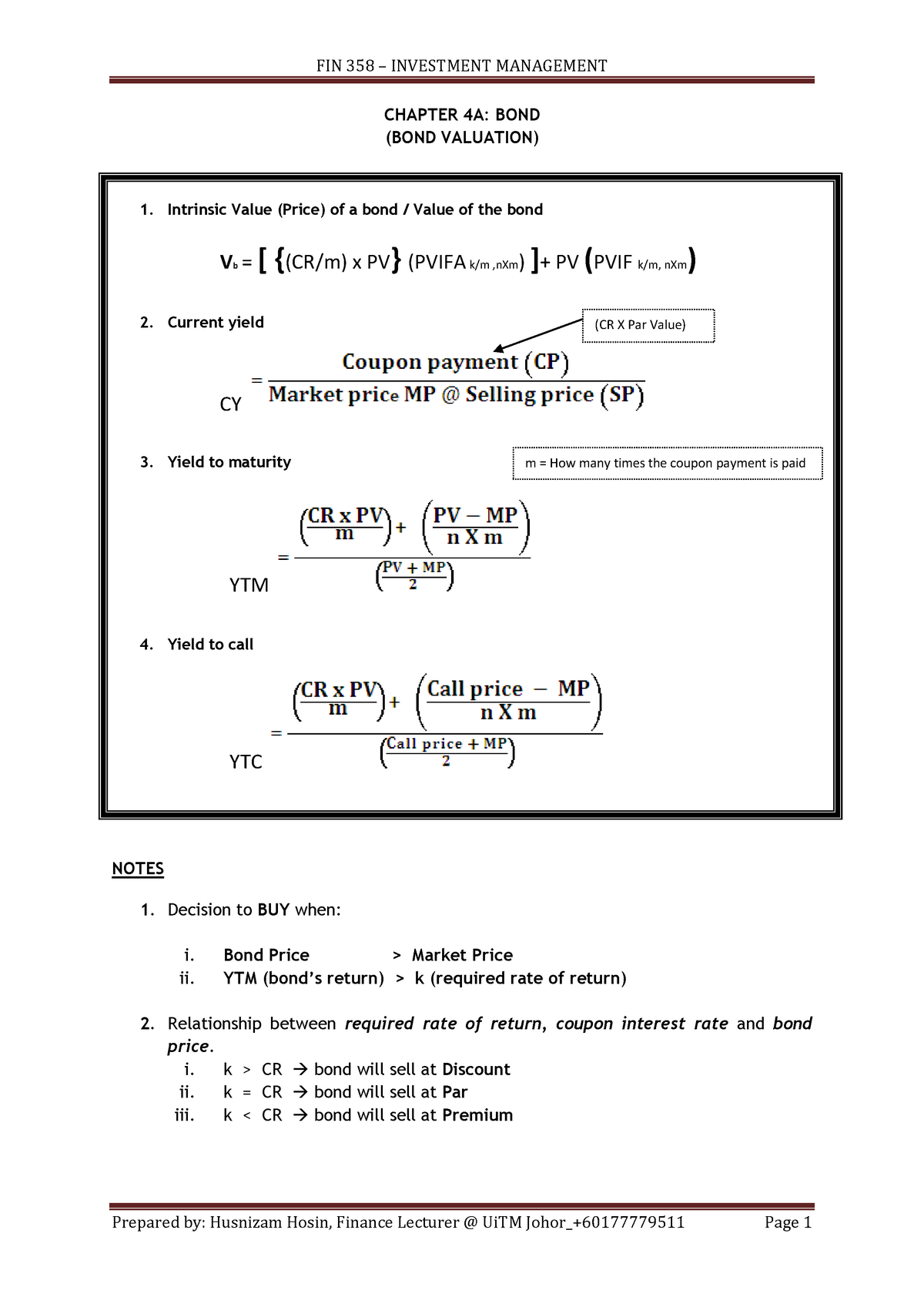

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Yield to maturity is the effective rate of return of a bond at a particular point in time. On the basis of the coupon from the earlier example, suppose the annual coupon of the bond is $40. And the price of the bond is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic Current Yield Calculator | Calculate Current Yield of a Bond Current Yield = Coupon Payment / Market Price of Bond Current Yield Definition Using the free online Current Yield Calculator is so very easy that all you have to do to calculate current yield in a matter of seconds is to just enter in the face value of the bond, the bond coupon rate percentage, and the market price of the bond. That's it!

Current Yield Formula (with Calculator) - finance formulas The formula for current yield only looks at the current price and one year coupons. Example of the Current Yield Formula. An example of the current yield formula would be a bond that was issued at $1,000 that has an aggregate annual coupon of $100. The bond yield on this particular bond would be 10%.

Current yield coupon rate

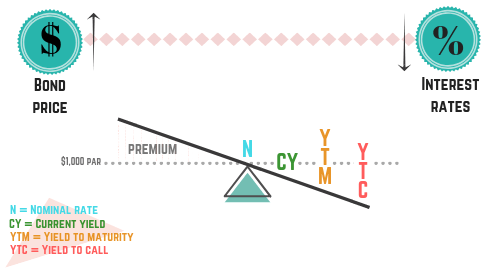

Bond Yield Rate vs. Coupon Rate: What's the Difference? The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is... Current Yield of a Bond - Meaning, Formula, How to Calculate? The current yield of A & B Bond will be calculated as follows: For Bond A Step 1: Calculate Annual coupon payment Face value * Annual coupon rate 1000 * 10% = 100 Step 2: Calculate Current Yield = Annual coupon payment / Current market price = 100 / 1200 = 8.33% For Bond B Step 1: Calculate Annual coupon payment = Face value * Annual coupon rate Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value.

Current yield coupon rate. Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same. › terms › cCurrent Yield Definition, Formula, and How to Calculate It Oct 30, 2020 · Current yield is an investment's annual income (interest or dividends) divided by the current price of the security. This measure looks at the current price of a bond instead of its face value ... Understanding Bond Yield and Return | FINRA.org Aug 11, 2022 ... Coupon yield, also known as the coupon rate, is the annual interest rate established when the bond is issued that does not change during the ... Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube We go through the coupon rate formula, current yield formula, and the yield to maturity formula. We also explain the difference between the face value and the market value of the bond and...

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The current yield compares the coupon rate to the market price of the bond. 4; The coupon amount remains the same till its maturity. The market price keeps on changing so it's better to purchase a bond at a discount which represents a larger share of the purchase price. 5; What Is Coupon Rate and How Do You Calculate It? - SmartAsset Later, Investor B buys the bond for $900 as the market has heated up and a safe instrument has lost value. Coupon and yield rates are: Coupon Rate: 10%. This does not change. Investor A Yield Rate: 9%. The investor paid $1,100 for a bond that returns only $100 per year, making their yield on the bond lower than its coupon rate. Investor B Yield ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet Unlike a coupon which is static, the yield is a dynamic value that accounts for the current price of the bond. Take a bond with a face value of $100, which we'll call XYZ bond. At inception, the bond's yield is equal to its coupon, because the bond price is at par, or at 100% of the face value. So at issuance it has a 5% coupon and a 5% yield.

› mbsMBS Dashboard - MBS Prices, Treasuries and Analysis View MBS prices and charts and follow the day's market activity with Micro News and Commentary. Coupon Rate Calculator | Bond Coupon Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate ... Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. For example, if an investor pays less than the face amount of a bond, the current yield ... What Is Current Yield? - The Balance Let's take a look at the math to calculate current yield. Again, if you receive $20 in annual interest on a bond with a par value of $1,000, the coupon rate is 2%. $20 / $1,000 = 0.02 X 100 = 2% As the market price of the bond changes, you divide the same interest payment by the current market value to get the bond's current yield.

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates, etc, Please provide us with an attribution link.

Bond Yield Calculator - Compute the Current Yield - DQYDJ Current Yield (%): The simple yield of the bond computed from the trading price and the coupon payments. Yield to Maturity (%): The converged solution for yield to maturity of the bond (its IRR) ... So, a bond trading at $920 with a face value of $1000 and a 10% interest rate has a 10.87% current yield, higher than the one stated by the bond. ...

Bond Current Yield Calculator Oct 14, 2022 ... Calculate the annual coupon. It depends on the face value, coupon rate, and coupon frequency. · Determine bond price. It is the market price of ...

Goi Loan - Bond Price, Yield Percentage, Coupon Rate | IndiaBonds This is called the coupon rate or coupon yield. Coupon Rate = Annual Interest Payment / Bond Face Value However, if the annual coupon payment is divided by the bond's current market price, the investor can calculate the current yield of the bond. Current yield is simply the current return an investor would expect if he/she held that investment ...

home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

Current Yield - Meaning, Formula and Calculation Suppose a bond's face value is Rs 1,000 and has an annual coupon rate of 7%. The coupon payment would be Rs 70. If the bond's current price is Rs 950, then it would be calculated as follows. Current yield = 70/95 = 7.3% This means that you can expect a 7.3% return from the bond investment you want to invest in it at the current price.

Current Coupon Definition - Investopedia Bonds that sell at a yield that is within ±0.5% of current market interest rates are said to have a current coupon status. Because their coupon rate is close to that set by the market,...

Current Yield vs. Yield to Maturity: What's the Difference? The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3 Calculating the yield to maturity is more complicated.

Current Yield | Formula, Example, Analysis, Calculator The current yield focuses more on its actual value now than on its value in the future. Current Yield Example Maria purchased a bond for $18,000. The bond has an annual coupon rate of 7%. This means her coupon amount would be $1260 per year. The market price of the bond is $14,500. What would the current yield be based on this market rate?

› current-yield-formulaCurrent Yield Formula | Calculator (Examples with Excel Template) Current Yield = Annual Coupon Payment / Current Market Price of Bond * 100% Relevance and Use of Current Yield of Bond Formula From the perspective of a bond investor, it is important to understand the concept of current yield because it helps in the assessment of the expected rate of return from a bond currently.

en.wikipedia.org › wiki › Current_yieldCurrent yield - Wikipedia Example. The current yield of a bond with a face value (F) of $100 and a coupon rate (r) of 5.00% that is selling at $95.00 (clean; not including accrued interest) (P) is calculated as follows.

What is Current Yield? (Formula + Calculator) - Wall Street Prep The formula for calculating the current yield on a bond is as follows. Current Yield = Annual Coupon ÷ Bond Price For instance, if a corporate bond with a $1,000 face value ( FV) and an $80 annual coupon payment is trading at $970, then the implied yield is 8.25%. Current Yield = $80 Annual Coupon ÷ $970 Bond Price = 8.25%

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05%

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA Coupon Rate or Nominal Yield = Annual Payments / Face Value of the Bond Current Yield = Annual Payments / Market Value of the Bond Zero-Coupon Bonds are the only bond in which no interim payments occur except at maturity along with its face value. Bond's price is calculated by considering several other factors, including: Bond's face value

home.treasury.gov › interest-rates › TextViewResource Center | U.S. Department of the Treasury coupon equivalent 8 weeks bank discount coupon equivalent 13 weeks bank discount coupon equivalent 17 weeks bank discount coupon equivalent 26 weeks bank discount coupon equivalent 52 weeks bank discount coupon equivalent 1 mo 2 mo 3 mo 4 mo 20 yr 30 yr; 01/02/2002: n/a : n/a : n/a : 1.71 : 1.74 : n/a : n/a

Current Yield vs. Yield to Maturity - Investopedia This is especially helpful for short-term investments . For example, if an investor buys a 6% coupon rate bond (with a par value of $1,000) for a discount of $900, the investor earns annual...

Coupon Rate: Formula and Bond Calculation - Wall Street Prep Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k each year for as long as the bond is still outstanding. Number of Periods (N) = 2 Coupon Payment = $6,000 / 2 = $3,000 Bond Coupon Payment Calculation Steps

› terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value.

Current Yield of a Bond - Meaning, Formula, How to Calculate? The current yield of A & B Bond will be calculated as follows: For Bond A Step 1: Calculate Annual coupon payment Face value * Annual coupon rate 1000 * 10% = 100 Step 2: Calculate Current Yield = Annual coupon payment / Current market price = 100 / 1200 = 8.33% For Bond B Step 1: Calculate Annual coupon payment = Face value * Annual coupon rate

Bond Yield Rate vs. Coupon Rate: What's the Difference? The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is...

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

Post a Comment for "42 current yield coupon rate"